Understanding the fundamentals of financial statements is essential for small business owners to make informed decisions and keep a healthy financial position. One of the most important financial statements you should know is the balance sheet.

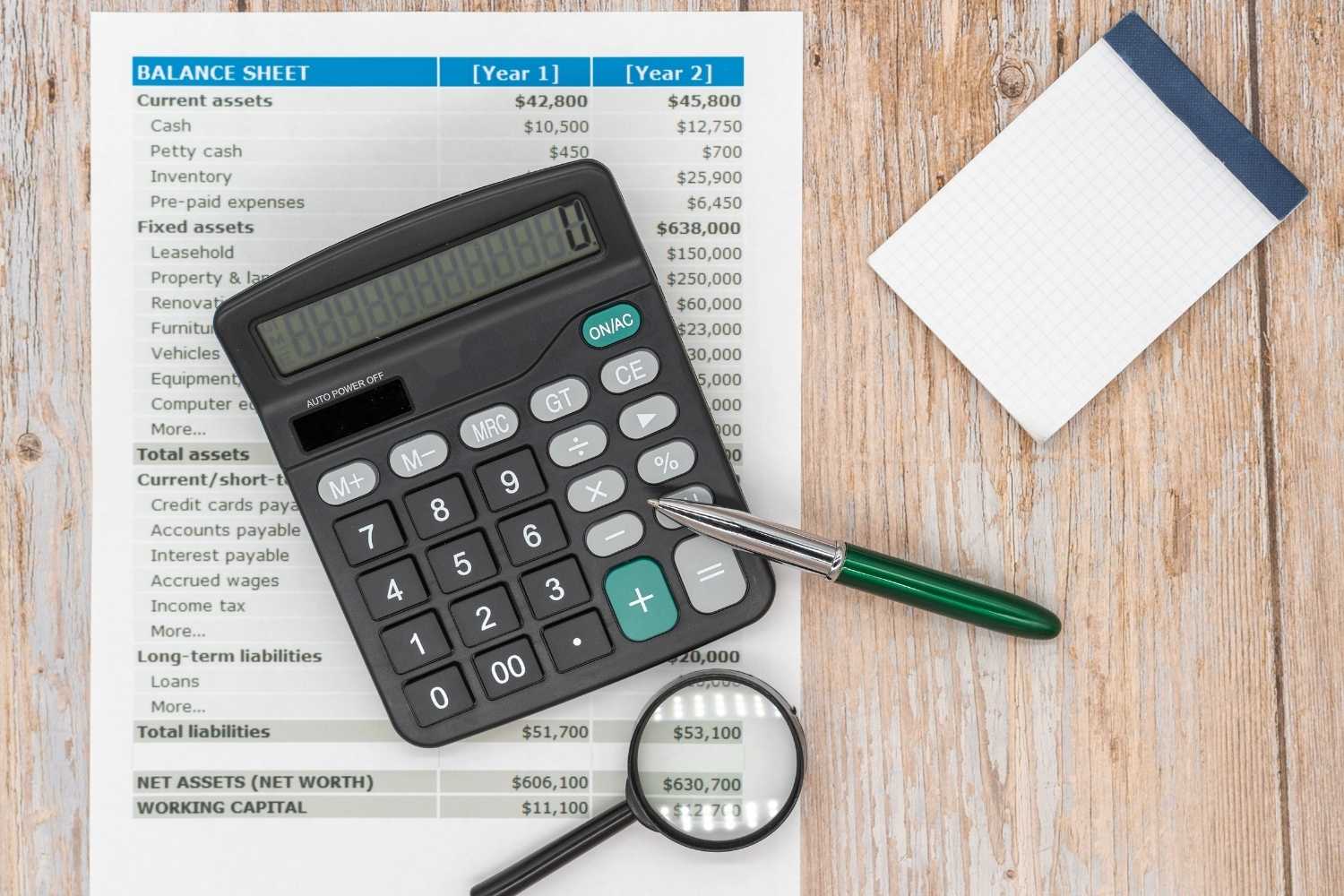

The balance sheet is a snapshot of your business’s financial health at a specific time. It gives you a detailed overview of your all assets, liabilities, and equity, allowing you to assess your company’s overall economic standing. Here, we’ll explore the basics of the balance sheet that every small business owner should know.

Assets: Assets are the resources your business owns or controls, which have monetary value. This includes cash, accounts receivable, inventory, equipment, and real estate. Assets are typically divided into current assets (those that can be converted into cash within a year) and non-current assets (long-term investments and property).

Liabilities are the debts and financial obligations your business owes to others. This includes accounts payable, loans, mortgages, and other outstanding payments. Liabilities are also categorized as current (due within a year) and non-current (long-term).

Equity: This represents the ownership interest in your business. It’s the difference between your total assets and liabilities, often referred to as the “net worth” of your company. Equity can come from various sources, such as retained earnings, owner investments, or stock sales.

Understanding the balance sheet provides valuable insights into your small business’s financial health. For example, you can use it to:

- Assess your liquidity and ability to pay short-term obligations

- Evaluate your debt-to-equity ratio and overall financial leverage

- Identify areas for improvement, such as reducing liabilities or increasing assets

If you’re a small business owner needing bookkeeping for general contractors, bookkeeping services for small businesses, or a bookkeeper in Hanover, NH, the Main Street Virtual: Bookkeeping and Operational Support team can help. We specialize in providing financial management solutions to businesses of all sizes, ensuring your financial processes are streamlined, and your books are always in order.

Remember, a strong understanding of your balance sheet is the foundation for making informed decisions that will drive your small business’s growth and success.